In today’s rapidly evolving financial landscape, millions of individuals and small business owners continue to struggle to access the capital and guidance necessary for achieving financial independence. Despite the growth of financial services, access remains uneven, particularly for those with average or moderate incomes.

Recognizing this global challenge, EiC Corporation has launched Ustart — a strategic initiative designed to promote financial inclusion and provide individuals with the tools, knowledge, and support they need to take control of their financial future.

I. The Importance of Financial Inclusion

Financial inclusion is more than just a development goal — it is a fundamental driver of economic growth and social progress. Yet, over 1.7 billion adults worldwide remain unbanked. Even among those with bank accounts, many faces significant obstacles, including high borrowing costs, limited financial products, and a lack of personalized advice.

This gap prevents individuals from building sustainable businesses, investing in their future, or improving their overall financial well-being. Ustart addresses this issue head-on by offering a comprehensive and accessible platform for financial empowerment.

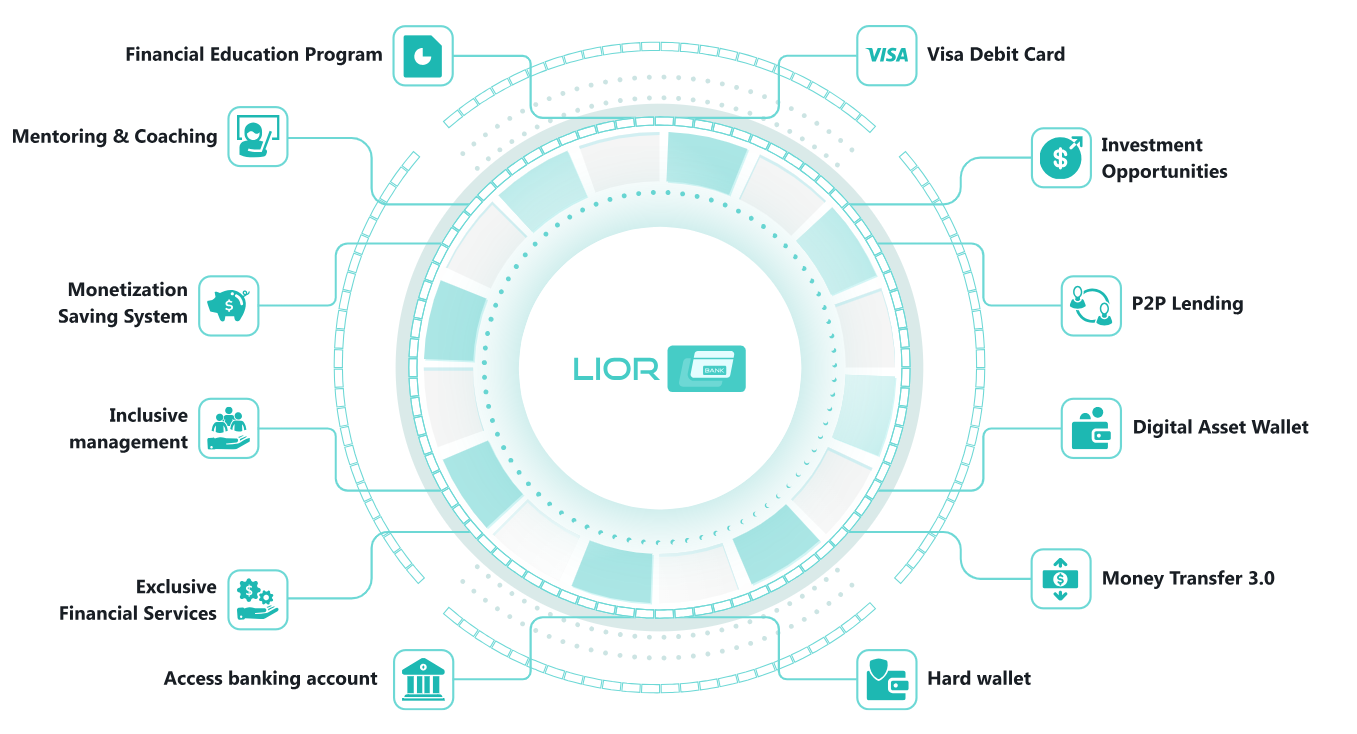

II. How the Ustart Program Works

Ustart is structured around four core pillars that together support a complete journey toward financial success:

1. Personalized Financial Coaching

Participants receive guidance from expert financial advisors to assess their current financial health, define their goals, and build strategic wealth-building plans.

2. Access to Tailored Funding Solutions

Ustart connects individuals with diverse financing options — from micro-loans to structured investment vehicles — designed to meet a variety of needs and project scales.

3. Professional Training and Mentorship

Through targeted workshops and mentorship sessions, participants gain practical knowledge and are introduced to a network of industry professionals, financial experts, and successful entrepreneurs.

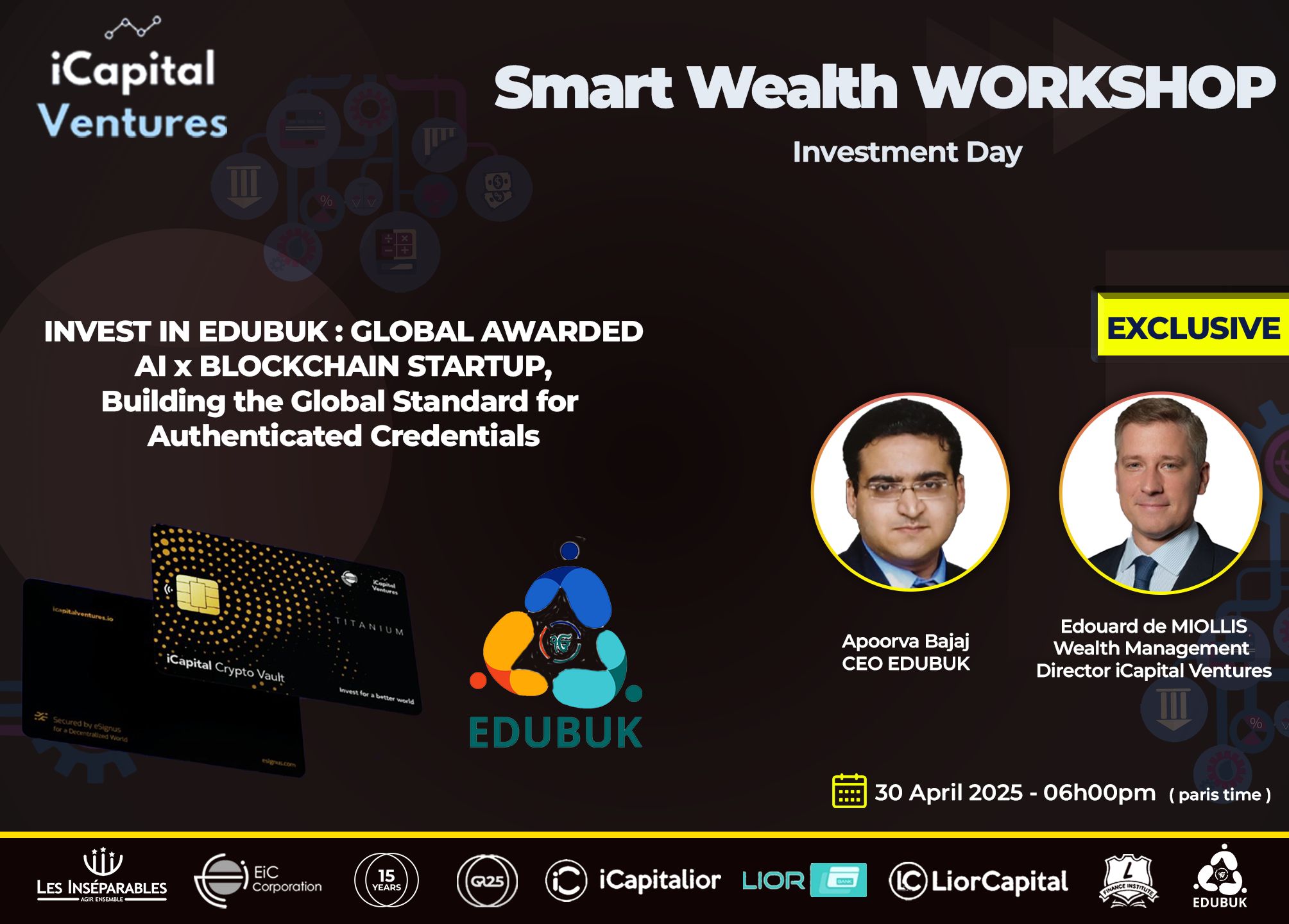

4. Startup Acceleration and Investment Readiness

Entrepreneurs receive support to refine their business models, improve operational strategies, and prepare for investment opportunities through access to networks and potential funders.

III. Driving Sustainable Economic and Social Impact

Research shows that increasing financial inclusion can boost GDP by up to 14 percent in developing economies and 8 percent in high-income countries. Furthermore, businesses that benefit from financial literacy and structured support are 30 percent more likely to survive beyond their first five years.

Ustart contributes to this broader impact by equipping individuals with the knowledge, capital, and confidence to make informed decisions, launch viable enterprises, and contribute to the development of more inclusive economies.

IV. A Pathway to Financial Empowerment

Access to financial resources should not be limited by geography, income level, or background. Ustart is committed to making financial opportunity universal — enabling individuals to move from ambition to achievement.

Whether you are a working professional aiming to improve your finances, an aspiring entrepreneur with a new idea, or a startup founder ready to scale, the Ustart Program is designed to support your growth.

Register today and take the first step towards financial independence and inclusive economic participation.

Link to register: https://docs.google.com/forms/d/e/1FAIpQLSf-b-wCnToXLPhJlK7hANHWmnnP_8hmqk0P9FLAepjEN9qfoQ/viewform?usp=header

Incription Link: https://www.eic-corporation.org/collect/choice/114021-y-eic-corporation

Share

00 Comments

No Comments found!